Key Retirement Planning - Steps To Be Taken

Retirement Planning is the most important part of Financial Planning that everyone for sure should take care. Retirement means not stop working and start killing time and being a burden to others. Retirement is the third delightful stage in a human’s life where the first stage was your childhood where you were dependent on your parents and the second stage is where you started earning and building your professional carrier and family.

There is a huge change in the financial behavior in all these 3 stages of your life. At Childhood you were dependent on your parents and when you move to the second stage you start earning and stop depending. You have to commit yourself to take the responsibility of your family’s requirement. This stage of your life is called as an accumulation stage – where you start creating assets and building wealth. Third stage (Retirement) of your life will be tricky and challenging, where you can’t depend on anyone for your requirements and also you’re earning potential will come down considerably and on the other hand your expense will ascend.

Retirement is the most delightful part of your life, where you must have accomplished your responsibilities and start living for you and the society. This stage of life is also called as discharge stage where you start utilizing the assets and wealth created by you for the rest of your life.

Now let’s consider the most important factors attributing your retirement planning.

These are the most important aspects you have to be cautious before deciding on a retirement plan.

You can use this as your control point to design your independent retirement plan.

- Present Lifestyle Cost: Amount of money spent on an average every month to maintain your Lifestyle

- Projected Inflation: Current inflation rate is 6.07%, this keeps varying with the market condition. On a brief the percentage in which the value of the money is lost by the end of the year.

- Retirement Age: This is your choice, if you choice to retire early you will have less no. of years to plan your retirement and hence the amount of investment will be more compared to if your choice is to delay your retirement age.

- Life Expectation: This again is your choice. Advised to plan for a longer life span as the average life span had increased with the advantage of the modern healthcare.

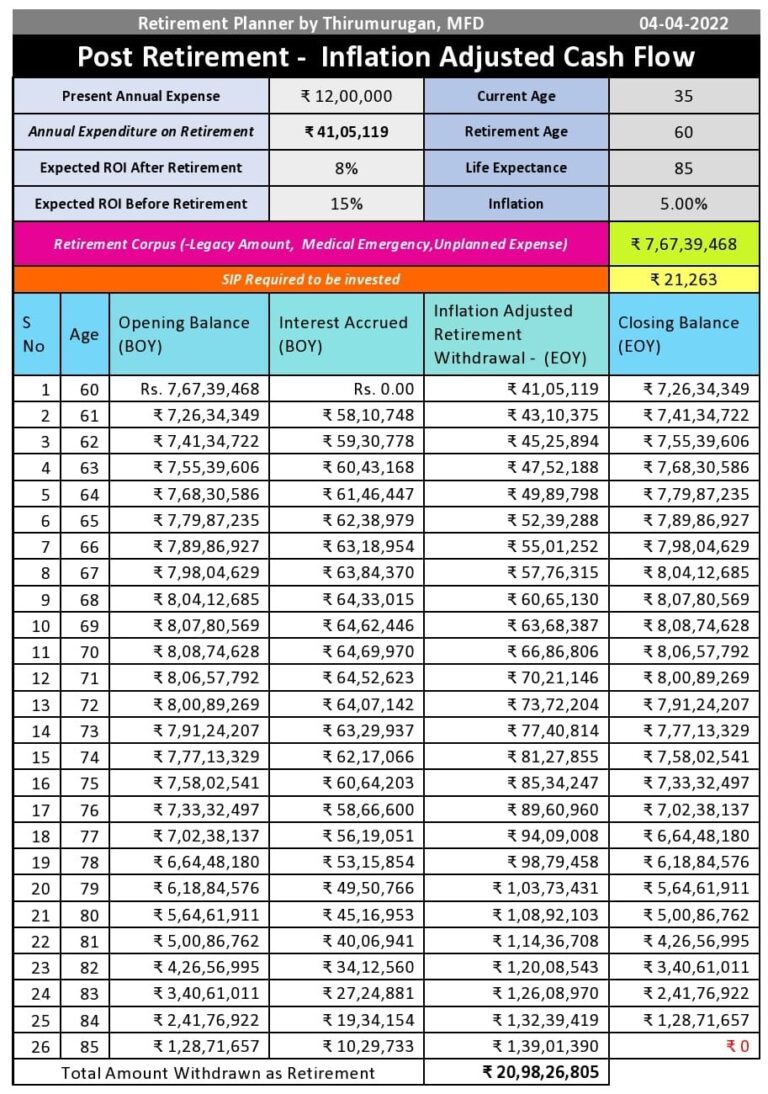

- ROI – Pre & Post Retirement: As a normal rule ROI pre-retirement can be more aggressive (12 – 15%) and post-retirement can be moderate (8 to10%).

- Corpus Amount: This is the amount of money you must accumulate at time of your retirement, such that this amount is invested in a conservative fund and a regular withdrawal can be planned.

- Legacy Amount: This is the amount of money you like to leave back to the next generation after your lifetime. Suggest a proper will needs to be created.

The next most important point to be vigilant is Inflation Adjusted Retirement Cash Flow. Almost all your Retirement Plans that are available in the market may not support this. A constant amount is paid throughout your retirement lifetime, where you have to start compromising on your lifestyle starting from the first year due to the killer inflation.

Kindly have a pleasant understanding on the below given working – wish our workings are self-explanatory, if required assistance we will be more happy to support you.